Mahila samman saving scheme post office

Mahila samman saving scheme post office 2023 (MSSC)

Mahila Samman Saving Certificate is new scheme launch by Modi government

specifically targeting for Women and girls for small saving. It was launch by Union

Finance Minister, Smt. Nirmala Sitharaman in her 2023-24 Budget speech.

The Mahila Samman Savings Certificate scheme was announced to

commemorate the Azadi ka Amrit Mahotsav.

The Mahila Samman Savings Certificate is a one-time scheme

available for two years, from April 2023-March 2025. This scheme is having heights return in short term 2 year only no other such scheme available in market or in post office itself. It will offer a

maximum deposit facility of up to Rs.2 lakh in the name of women or girls for

two years at a fixed interest rate.

Features of Mahila Samman Savings Certificate as below

Feature of

this MSSC scheme –

1.

Scheme backed by the government. Hence, it

does not have any credit risk.

2.

The Mahila Samman Savings Certificate can be

done only in the name of a girl child or woman.

3.

The minimum deposit amount under the Mahila

Samman Savings Certificate is Rs.1,000 in multiples of rupees one hundred. The

maximum deposit amount is Rs.2 lakh in one account or all Mahila Samman

Savings Certificate accounts held by an account holder

4.

The maturity period of the Mahila Samman

Savings Certificate account is two years.

5.

A partial withdrawal facility is provided

under the Mahila Samman Saving Certificate scheme. The account holder can

withdraw up to 40% of the account balance after one year from the account

opening date.

6.

TDS will apply only when the interest received

from the post office savings scheme in a financial year is more than Rs.40,000

or Rs.50,000.

7.

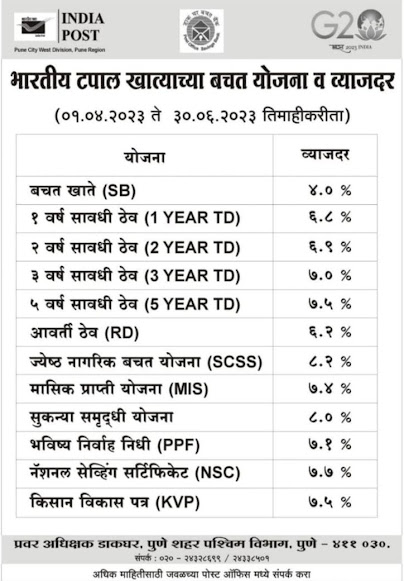

This scheme has a fixed interest rate of 7.5%

p.a., much higher than most bank Fixed Deposits (FDs) and other popular small

savings schemes.

8.

No tax deduction under Section 80C ( Till

date there is no provision as such )

.

Where to Open a Mahila Samman Savings Certificate?

Documents

Required for Mahila Samman Savings Certificate Account

Application form

KYC documents, such as an Aadhaar card, Voter ID, driving license

and PAN card

KYC form for new account holders

Pay-in-Slip

Comments

Post a Comment